Abstract

- Beware phishing emails focusing on individuals not cautious with private info.

- Third-party distributors acquire knowledge for advertisements; know the place your information goes.

- Use disposable bank cards for monetary safety, setting limits and avoiding subscription renewals.

Some individuals do not take their safety and id significantly. There is a motive that scammers have created issues like phishing emails, which goal individuals who could not have good filters on their electronic mail packing containers and do not take note of what an electronic mail says earlier than clicking a hyperlink. They continue to be efficient, which is why lots of them nonetheless exist as we speak. If you’re somebody that is not cautious together with your personal information, there’s nonetheless time to alter.

Monetary knowledge may be shared fairly shortly and effortlessly. With a purpose to take an additional step in that safety, you may strive utilizing a disposable bank card. Disposable credit cards are sometimes referred to as digital bank cards. A disposable bank card is one that’s supplied to you by your bank card firm. It’s meant for use whereas on-line procuring and is a digital bank card with a special quantity than your regular bank card. That is carried out to guard your common bank card quantity. You will not get the identical quantity twice for those who use a disposable bank card for a web-based buy. It’s a quantity that’s linked to your account however is just not the quantity in your bank card. Listed below are some explanation why you may use a disposable bank card.

Associated

This VPN feels like it’s in a league of its own

On the finish of the day, you must decide one which’s best for you.

5

You are making an enormous buy

This protects your info from being stolen

cardmapr-nl / Unsplash

The numbers on a disposable bank card are, by design, solely good for one buy. It’s then made invalid by the bank card firm, defending your id and private info whereas permitting you to make an enormous buy with out worrying about your precise bank card quantity being compromised.

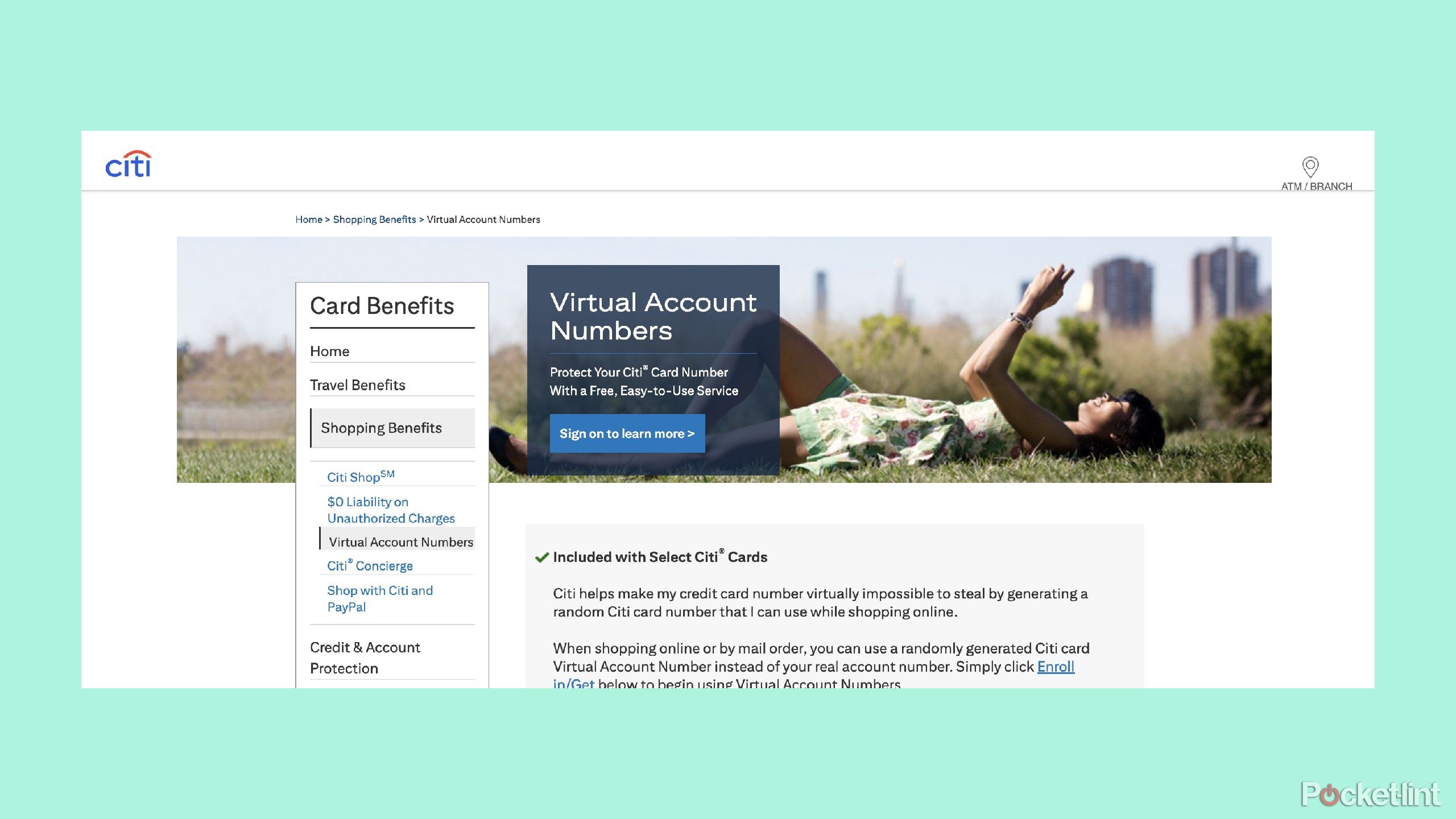

Digital bank cards have been obtainable by some firms for the reason that early 2000s.

There are solely two bank card firms that at present provide digital bank cards. Capital One and Citibank permit customers to enroll in digital bank cards. They had been beforehand supplied by American Categorical and Uncover, however are now not choices with both firm.

Utilizing a bank card with a disposable quantity is sensible if you end up making a big buy and wish to defend your info. This could just be sure you’re solely charged as soon as to your account for that quantity, including an additional layer of safety to your account. It is usually a good suggestion to think about using this sort of bank card for those who’re buying from an internet site which may not have the very best safety round it. Utilizing a browser that may flag unsafe web sites may also cease you from doing this.

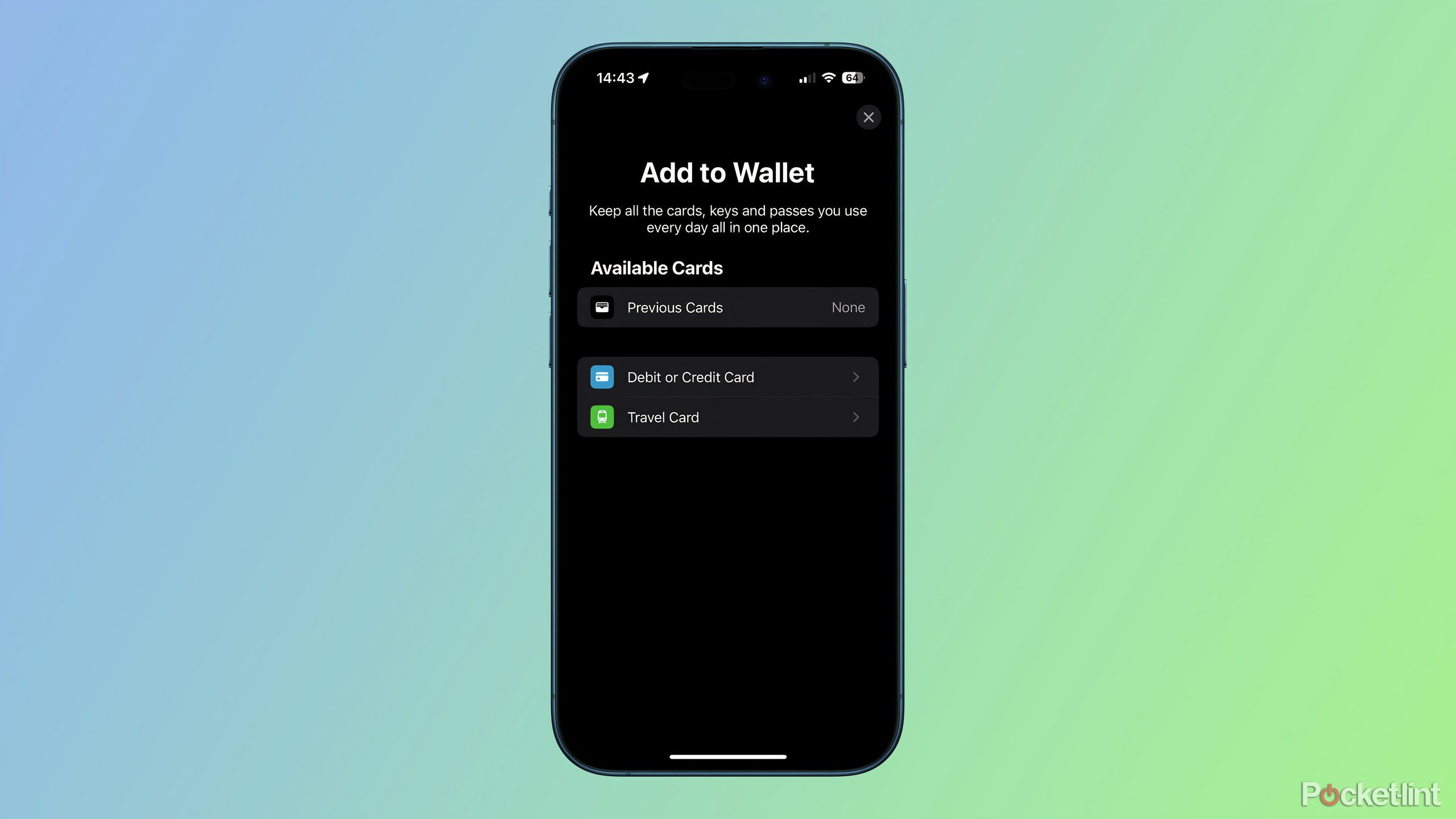

Associated

5 Apple Pay moves that make checkout faster, smarter, and better

You undoubtedly aren’t utilizing Apple Pay proper if you do not know these methods.

4

When you do not wish to overspend

Not a nasty thought for somebody studying to make use of a bank card

For any bank card, you may set a restrict for a way a lot you are allowed to spend at a given time. Usually, individuals simply depart it because the set restrict allowed by the bank card firm. However, if you wish to cease your self from making giant purchases, you may prepare for a disposable bank card quantity to be linked to a sure amount of cash. Which means, if you use the digital bank card quantity, you may solely use it for a certain amount.

You have not used it in months however now you are paying for it for one more yr. Utilizing a one-time bank card quantity would cease that.

It’s sensible to place a cap in your spending and utilizing a digital quantity is an effective manner to do that. Once you activate the function with both Citibank or Capital One (in case your card presents this,) you may designate the quantity you may spend with it. It is a good thought for somebody who could also be studying methods to use credit score and is making an attempt to construct some up by making smaller purchases.

Associated

As a rule, any safety threats are oblique relatively than by way of Apple Pay itself.

3

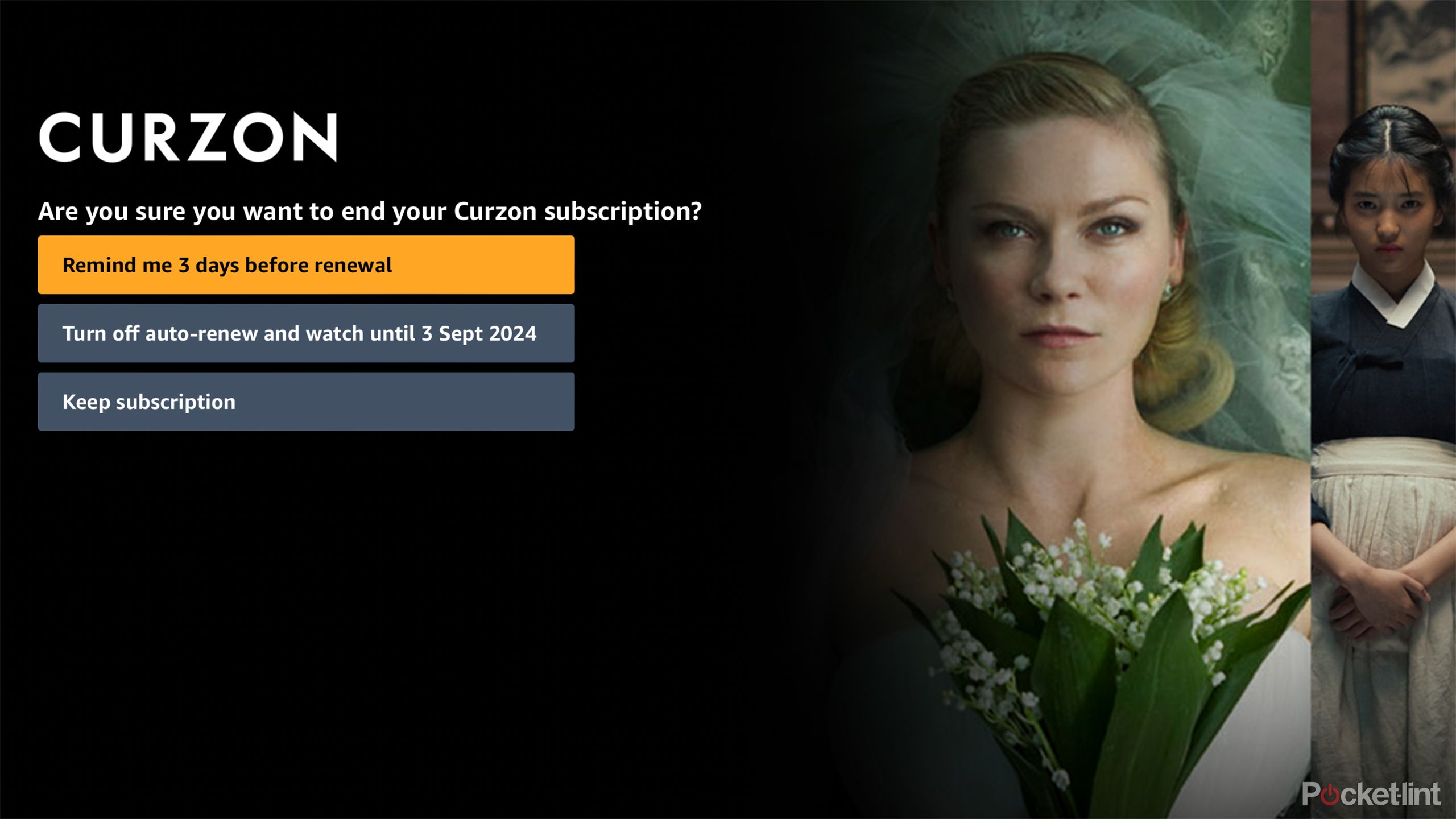

Cease a renewal in its tracks

Do not get hit up twice for a similar buy

For example you are signing up for a brand new streaming service since you wish to watch a selected present on it. You understand it’s going to take you longer than the trial interval to take action, that means your fee will get charged a minimum of as soon as. If you realize that you do not need the service after ending this one present, utilizing a digital bank card quantity will eradicate the likelihood that it auto-renews.

Loads of us are horrible at remembering to cancel a subscription as a result of we simply overlook. It is an annoying cost to search out in your bank card assertion {that a} random subscription auto-renewed since you merely forgot to cancel it. You have not used it in months, however now you are paying for it for one more yr. Utilizing a one-time bank card quantity would cease that.

Associated

I just found a goldmine of top-tier shows – no subscription required

Tubi is the place to go for the very best in basic TV.

2

When you do not wish to maintain utilizing the cardboard

There are methods to cease your self from utilizing it

If you realize you wish to use a digital bank card however you are not positive when, you may enroll for one proper now. Any time you wish to use it, your card will give you a brand new bank card quantity. However, you can even cease utilizing the digital numbers at any time. That is as a result of you could have the choice of selecting how lengthy you are allowed to make use of them.

Which means you could have the flexibility to manage how typically and the way little you utilize a disposable bank card. You possibly can set a time period restrict that claims you need to use it for a yr after which you must return to utilizing your common bank card quantity. Any time you’ll be utilizing the service, your bank card firm will create a brand new quantity for you in that occasion. It’s nonetheless linked to your bank card account, however is not obtainable for a couple of use. After a yr or regardless of the restrict you could have set in your account, this would possibly not be the case anymore.

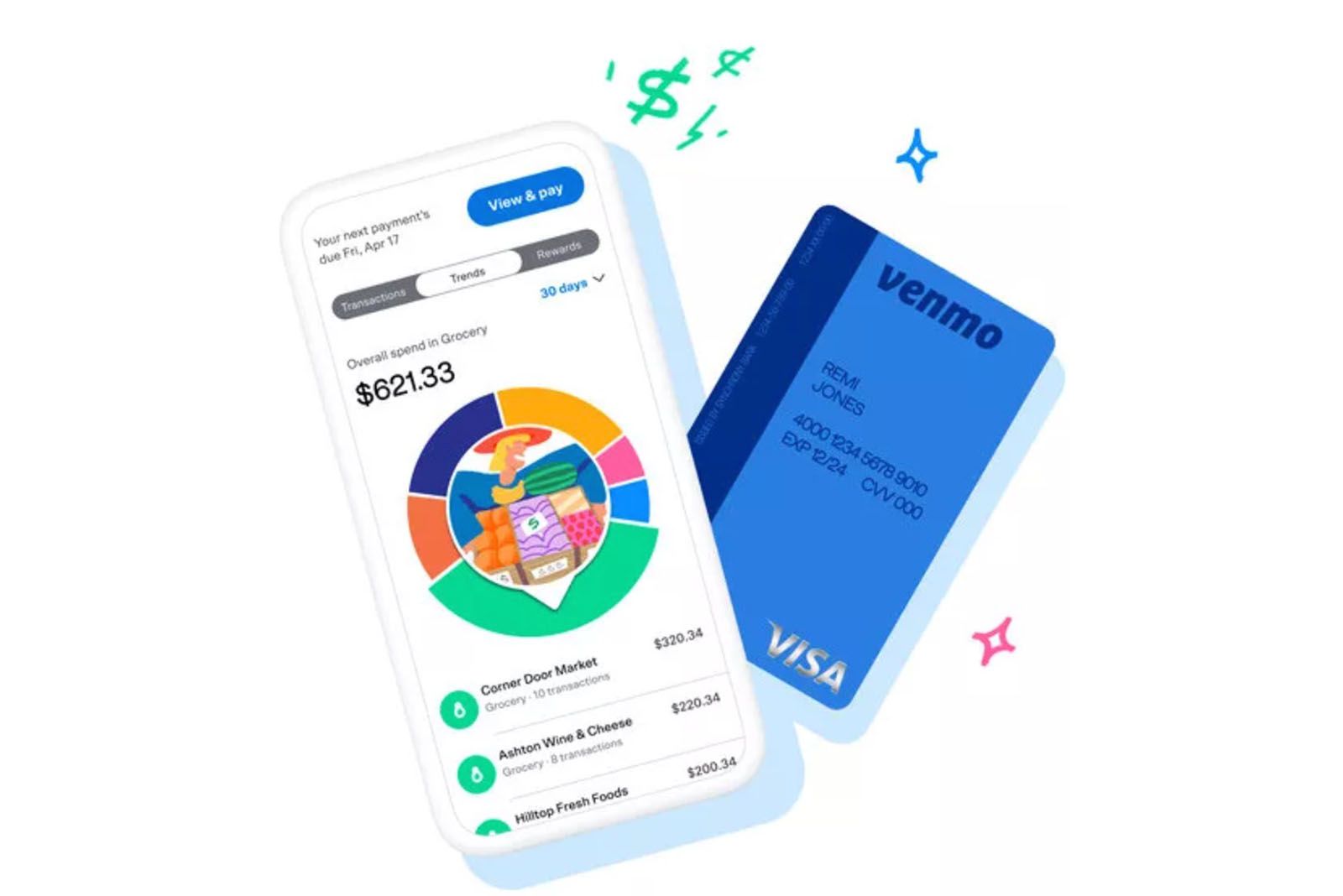

Associated

What is the Venmo Credit Card, how does it work, and does it offer rewards?

Do you know Venmo presents a bank card?

1

Once you wish to order one thing on the telephone

It is onerous to belief somebody to not use your card

Making an attempt to position an order for one thing over the telephone? It may be dangerous to present somebody your bank card quantity whereas speaking to them. They should ask your identify, bank card quantity, expiration date, and CSV code. That is just about giving them every part they should know to make use of your bank card once more. If you’re making a purchase order and really feel uncomfortable offering all of that info over the telephone, utilizing your disposable bank card quantity could possibly be the best transfer.

You have to to test together with your bank card supplier if it is a risk. It has occurred previously the place bank card firms solely allowed digital bank cards for on-line purchases. However, it’s doable you may be approved to make use of it for a over-the-phone transaction. Perceive what your organization’s coverage is earlier than you do this.

Trending Merchandise

SAMSUNG FT45 Series 24-Inch FHD 1080p Computer Monitor, 75Hz, IPS Panel, HDMI, DisplayPort, USB Hub, Height Adjustable Stand, 3 Yr WRNTY (LF24T454FQNXGO),Black

KEDIERS ATX PC Case,6 PWM ARGB Followers Pre-Put in,360MM RAD Assist,Gaming 270° Full View Tempered Glass Mid Tower Pure White ATX Laptop Case,C690

ASUS RT-AX88U PRO AX6000 Dual Band WiFi 6 Router, WPA3, Parental Control, Adaptive QoS, Port Forwarding, WAN aggregation, lifetime internet security and AiMesh support, Dual 2.5G Port

Wi-fi Keyboard and Mouse Combo, MARVO 2.4G Ergonomic Wi-fi Pc Keyboard with Telephone Pill Holder, Silent Mouse with 6 Button, Appropriate with MacBook, Home windows (Black)

Acer KB272 EBI 27″ IPS Full HD (1920 x 1080) Zero-Body Gaming Workplace Monitor | AMD FreeSync Know-how | As much as 100Hz Refresh | 1ms (VRB) | Low Blue Mild | Tilt | HDMI & VGA Ports,Black

Lenovo Ideapad Laptop computer Touchscreen 15.6″ FHD, Intel Core i3-1215U 6-Core, 24GB RAM, 1TB SSD, Webcam, Bluetooth, Wi-Fi6, SD Card Reader, Home windows 11, Gray, GM Equipment

Acer SH242Y Ebmihx 23.8″ FHD 1920×1080 Home Office Ultra-Thin IPS Computer Monitor AMD FreeSync 100Hz Zero Frame Height/Swivel/Tilt Adjustable Stand Built-in Speakers HDMI 1.4 & VGA Port

Acer SB242Y EBI 23.8″ Full HD (1920 x 1080) IPS Zero-Body Gaming Workplace Monitor | AMD FreeSync Expertise Extremely-Skinny Trendy Design 100Hz 1ms (VRB) Low Blue Gentle Tilt HDMI & VGA Ports